Blockchain payments are revolutionizing payment systems, offering unparalleled speed, enhanced security, and greater accessibility for sending and receiving money.

This is particularly impactful in regions where traditional banking infrastructure is lacking or inefficient, enabling seamless transactions and financial inclusion on a global scale.

By utilizing decentralized, secure, and transparent methods of transfer value, blockchain technology has a transformative impact on payment systems. Different payment systems in the world are currently using blockchain to perform transactions, especially for cross-border payments, remittances, digital wallets, and some government-backed currencies.

Table of Contents

Advantage of blockchain in payment system

Security: Its problem-solving strength lies in its ability to use cryptographic techniques which ensure data integrity and that’s where it’s useful, to limit fraud in payments.

Transparency: This provides key accountability with aid for audit trails for every transaction on a blockchain, occurring in a ledger visible to authorized parties.

Speed: Concerning cross-border payments, blockchain can cut down on transaction times by a large margin. Blockchain payments can be near instant, but traditional systems can take days.

Lower Transaction Costs: The blockchain facilitated a reduction in costs for transactions, which makes it especially helpful with micropayments and cross-border transfers.

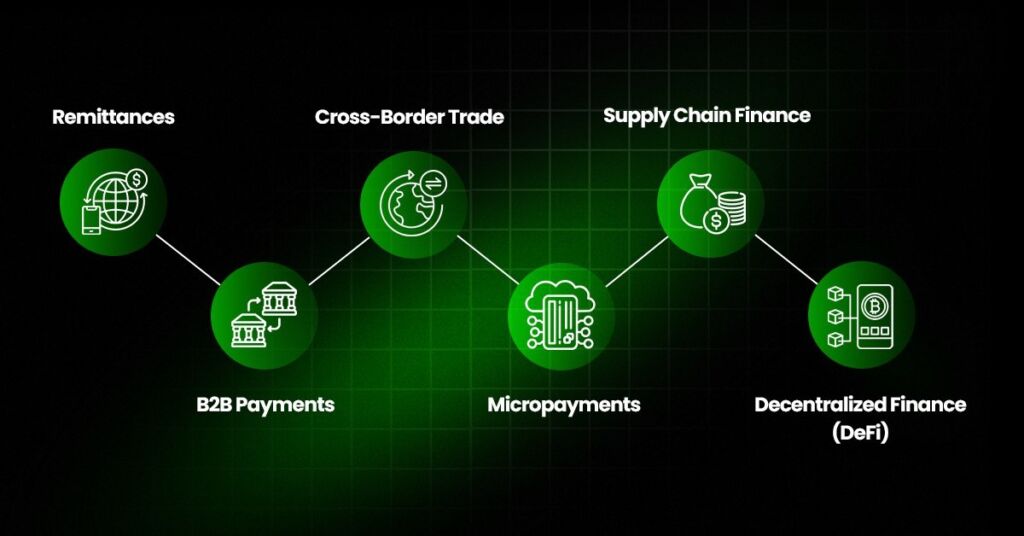

Payment Systems applications

1. Cross-Border Payments: Blockchain payments are popular internationally , where it simplifies the process by getting rid of multiple intermediaries that, for example with money transfer via the SWIFT system, made the process more time-consuming and expensive.

2. Remittances: These remittance payments are vital for many people, but are too often sent through expensive, slow channels. To help workers overseas send money to their families, blockchain-based services have made it efficient and cheaper at the same time.

3. Digital Currencies (e.g., CBDCs): A growing number of governments are experimenting with Central Bank Digital Currencies (CBDCs) – using blockchain to create digital representations of national money to facilitate faster and more efficient domestic payments.

4. Payment Gateways and Merchant Adoption: Blocks can be used by businesses to allow customers to spend payment without the traditional credit or debit card, instead, via cryptocurrencies.

5. Smart Contracts for Automated Payments: Since recurring payments, escrow arrangements, and especially decentralized finance (DeFi) applications are quite common, this is useful.

Limitations

· Regulatory Concerns: Blockchain payments are only recently regulated in many countries, especially about anti-money laundering (AML) and know-your-customer (KYC) rules.

· Scalability: Although a proof of concept, the theoretical fundamentals (complementary proof of stake methods and distributed consensus for creating distributed data structures) were applied to Bitcoin in one of the first implementations.

Some blockchains particularly early versions like Bitcoin lack the scalability to handle heavy bandwidths (i.e. transaction times are slow and fees spike at peak periods).

· Volatility in Cryptocurrencies: While blockchain is for different cryptocurrencies, value can go up or down dramatically. New is stablecoins, which are pegged to fiat currency but are still very new.

· Legacy Systems: The process of transitioning to a blockchain is a rather big challenge for traditional financial institutions.

Future Outlook

With their growing gains in payments, blockchain is expected to continue growing in various payment areas, such as cross-border transactions and remittances.

Overall, blockchain technology offers great promise as an alternative to traditional payment systems due to the increased speed, security, and accessibility — wherever there are people — which may be particularly beneficial in underserved areas. This, however, will likely need some regulatory support and technological innovation to spread, widely.

Payment systems currently using blockchain technology

Cross-Border Payments

1. Ripple (XRP): Financial institutions use Ripple Labs’ payment network, RippleNet, to make cross-border transactions. Ripple’s blockchain solution is based on near-instant settlement of transactions which is an alternative to SWIFT systems and reduces both time and costs.

2. Stellar (XLM): Another blockchain platform for cross-border payments is Stellar. It enables low-cost and fast transactions, which is most useful in making payments between uncommon or different currencies. IBM has partnered with another Stellar project on cross-border payments.

Digital Remittances

3. MoneyGram and USDC: To collateralize cross-border remittances, the Stellar blockchain was partnered with MoneyGram to use their USDC stablecoin, pegged to the U.S. dollar. It means users can send money across borders at greatly reduced fees and faster processing time.

4. Western Union: Taking a leaf out of its competitors’ book, Western Union has been exploring blockchain to help speed up its remittance services. They have not moved all the way but have tested multiple pilots on blockchain platforms to speed up and make cheaper, transfers.

Central Bank Digital Currencies

5. China’s Digital Yuan: They become one of the first major economies that go on the road towards a central bank digital currency (CBDC) using blockchain tech. China’s Digital Yuan plans to modernize the country’s payment system of state-backed digital transactions for domestic consumers.

6. Bahamas’ Sand Dollar: In early 2020, the Bahamas launched its own fully implemented CBDC, one of the first. The network is built on blockchain to allow secure transactions and bring financial inclusion to remote islands without banking access.

7. European Union and Digital Euro: As an alternative payment system within the EU, the European Central Bank (ECB) is currently exploring using a blockchain-based ‘Digital Euro’. It wants to be a safe digital asset that complements cash in retail payments.

Payment Processors for Cryptocurrency

8. BitPay: Merchants can accept Bitcoin and other cryptocurrencies with BitPay. With that, the project mitigates the risk of volatility for merchants and allows consumers to pay with their digital assets by converting the cryptocurrency into fiat at sale time.

9. Coinbase Commerce: The market payment system is Coinbase’s proposal for businesses to be able to accept cryptocurrency payments: Bitcoin, Ethereum, Litecoin, etc. Coinbase Commerce integrates with online stores so merchants can make crypto easier for both sides.

Stablecoins for Transactions

10. Tether (USDT) and USD Coin (USDC): Used in blockchain-based payment systems as instant yet stable value settlement vehicles, these stablecoins are pegged to the U.S. dollar.

In regions with high inflation, stablecoins are a favorite among users because they allow people to send money around without worrying about the volatility of other cryptocurrencies.

11. Diem (formerly Libra): Diem never launched, but its vision was a stimulus for stablecoins for payments and inspired financial institutions to start their own digital currency projects.

Decentralized Finance (DeFi) and Blockchain Payment Networks

12. Lightning Network (for Bitcoin): By processing off-chain, the Lightning Network was designed for small, fast transactions (micropayments). That means you can use Bitcoin for real-time, low-fee payments.

13.DeFi Payment Apps (e.g., Uniswap): DeFi platforms allow peer-to-peer payments and decentralized exchanges without the need for traditional banks to transfer or exchange those assets they have. But DeFi apps are moving away from being primarily a trading mechanism, and are increasingly enabling peer-to-peer payments.

NFTs and Tokenized Payments

14. Ticket Sales and Events: For example, now some companies place their ticket for an event in the form of NFT. This technology can solve problems like coordinating the ticketing process, fighting fraud, and transferring or reselling tickets easily and quickly.

15. Loyalty Programs and Rewards: Token-based loyalty programs are also gaining traction as blockchain use cases. For example, Starbucks has implemented its loyalty program through blockchain that allows users to earn ‘points’ (in token form) that can be redeemed for or traded for rewards.

Government and non-government Trials

16. India’s e-Rupee: India is testing a digital currency that will increase access to financial services for the unbanked. The e-rupee is believed to work as a blockchain-backed payment method, primarily for domestic use, adding to the growing popularity of blockchain payments.

17. Switzerland’s Project Helvetia: Instead, the Swiss National Bank has partnered with each other on a wholesale CBDC that would operate on a blockchain. Project Helvetia is an experiment of digital central bank money for commercial banks in the Swiss financial system.